Table of Contents

Introduction

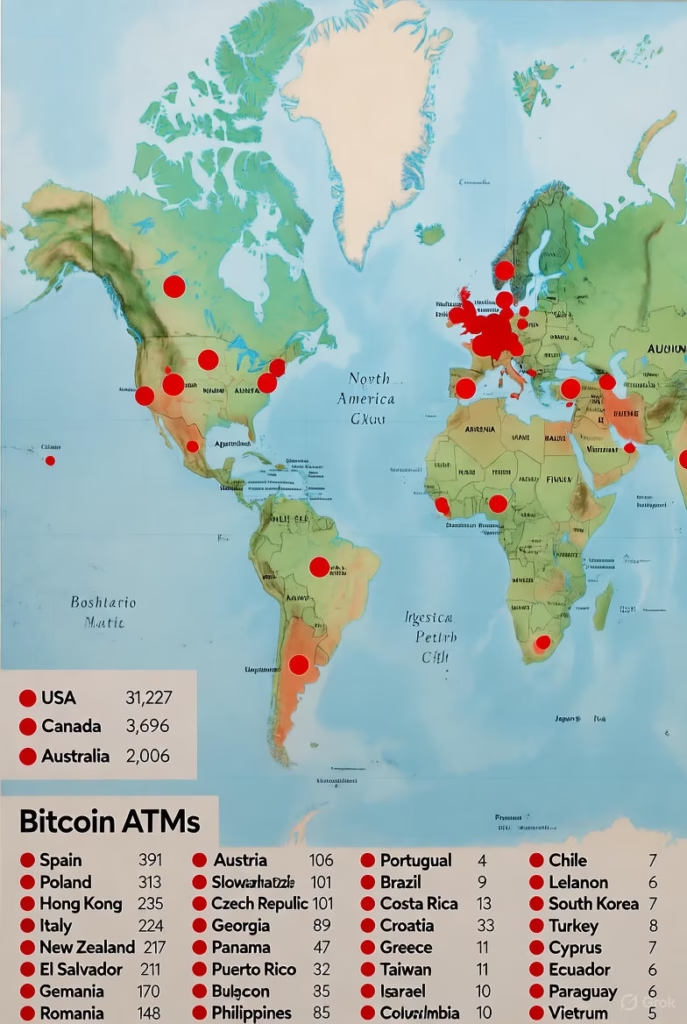

In the world of cryptocurrency, Bitcoin ATMs represent a revolutionary yet controversial innovation, challenging traditional banking by bringing digital currency within reach of the common people. In 2025, as global crypto adoption reaches its peak, Bitcoin ATMs have not only become a convenient medium for buying and selling but also the center of scams and regulatory debates. With over 39,000 active machines worldwide,

these ATMs offer an easy pathway to convert cash into crypto, but high fees, fraud risks, and grey-area status in countries like India make them risky as well. This report discusses in detail the definition of Bitcoin ATMs, reasons for trending, global/Indian statistics, legal status, RBI’s stance, community reactions, user benefits, risks, and future possibilities. From crypto enthusiasts to cautious investors, this guide will inform and empower you.

What is a Bitcoin ATM?

A Bitcoin ATM (or crypto ATM) is a special type of machine or kiosk that facilitates the buying or selling of Bitcoin and other cryptocurrencies. It is different from a normal ATM in that it buys and sells digital currency using cash or debit/credit cards, but it does not withdraw cash. The user connects their wallet by scanning the QR code on the machine, depositing cash, and in return, the Bitcoin is transferred to their wallet.

These machines are usually installed in shops, malls, or petrol pumps, and they incur high fees – sometimes up to 5-20%. Millions of such machines are available worldwide by 2025.

Why is Bitcoin ATM Trending?

Bitcoin ATM trending in October 2025 is mainly due to the increasing cases of scams. According to the US FBI, scams through Bitcoin ATMs in 2024 caused Americans to lose about $250 million (about Rs 2,100 crore), which is double from the previous year. Scammers force people to deposit money at a Bitcoin ATM by making fake calls (such as in the name of “IRS” or “police”), and once the money is sent they disappear. In recent days, there have been several reports in media such as CNN and ABC News, which are calling these machines the new weapon of criminals.

Recent posts on X (formerly Twitter) also feature the rising cases of Bitcoin ATM scams in Idaho, and fraud warnings in Canada. Although some people consider them to be easy entry points to crypto, there are awareness campaigns due to scams. If you’re planning to use a Bitcoin ATM, always verify with trusted sources and start with a small amount.

Current Trend

Number of Active Bitcoin ATMs in 2025

As of October 2025, the total number of active Bitcoin ATMs worldwide is approximately 39,374. This number dates back to the end of September 2025, when 648 new machines were added in Q3 (July-September), increasing the total number from 38,726 to 39,374. At the beginning of the year (January 2025), it was 38,768, that is, in 2025, about 600-700 new machines have been installed so far. This figure is based on Coin ATM Radar and other reports, and it reflects the rapidly increasing crypto adoption.

Which country has the highest growth?

The US leads the growth (new installations) of Bitcoin ATMs in 2025 . The US has installed the most new machines throughout the year – for example, 513 additions in Q2 and the most additions to leadership in Q3. In August 2025 alone, the US added 122 new machines. The US has the largest market compared to other countries (more than 80% of total ATMs), and the growth rate is also strong.

Other major countries:

- Canada: Good growth, but lower than in the US (58 new in June).

- Australia: Sharp growth in percentage (4.1% in August, 79 new), but the US lags behind in overall numbers.

- Spain and Poland: Leaders in Europe, but lower overall growth.

| country | Estimated Total ATMs (2025) | New Additions in 2025 (Examples) |

| America | ~31,000+ | 513 (Q2) + 122 (Aug) |

| Canada | ~2,500+ | 58 (Jun) |

| Australia | ~1,000+ | 71 (Jun), 79 (Aug) |

| Spain | ~200+ | Moderate growth |

| Poland | ~150+ | Moderate growth |

India View

Legal Status of Bitcoin ATMs in India

As of 2025, the legal status of cryptocurrencies (which include Bitcoin ATMs) in India is in the grey area. These are neither fully legal tenders nor bans. Key Points:

- Not Legal Tender: Bitcoin or other virtual digital assets (VDAs) are not recognized as legal tender. They cannot be used for payments.

- Taxation: 30% tax from the 2022 budget is levied on income, plus 1% on TDS transactions. This heavy taxation discourages crypto.

- Regulation: The Supreme Court in 2020 removed the RBI’s 2018 ban, allowing banks to offer services to crypto exchanges. But FIU-IND (Financial Intelligence Unit) issued AML (Anti-Money Laundering) compliance notices to 25 offshore crypto platforms in October 2025, including Hui one. Bitcoin ATMs are not specifically regulated, but they fall under crypto transactions, so are considered risky and unauthorized.

- Crackdown: The RBI did not grant a license to any entity to deal in Bitcoin. The CBDT (Central Board of Direct Taxes) is seeking feedback from stakeholders on the new VDA legislation in August 2025.

Check KYC/AML before using Bitcoin ATMs, as offshore models are at risk of being banned.

RBI’s stance Bitcoin ATMs

The RBI’s stance on crypto and Bitcoin ATMs is casualties and discouraging. Highlights:

- No Authorization: The RBI has clearly stated that no company has been given a license to run Bitcoin or crypto schemes. They consider financial stability as a threat.

- CBDC Focus: In October 2025, Union Minister Piyush Goyal said that only asset/sovereign backing cryptos will be supported. The RBI is promoting the Digital Rupee (CBDC), which will be similar to US stablecoins – fast, safe, and traceable. Private cryptos or stablecoins are being discarded.

- Risks: Crypto can affect monetary policy, capital controls and inflation. New RBI Governor Sanjay Malhotra said in June 2025 that the stance is unchanged – crypto can ‘hamper’ financial stability.

- New Framework: Introduced a tiered system in 2025, where regulated entities can offer basic banking services to crypto exchanges, but with strict tax/registration.

The RBI is prioritizing CBDC, while private crypto wants to be kept in a controlled environment.

Reactions of the Crypto Community

The RBI’s stance in the crypto community has mixed reactions – frustration, adaptation, and calls for dialogue. Highlights from recent posts on X (Twitter) (January-October 2025):

| Reaction Type | example | Engagement (Likes/Reposts) |

| Shock/Bombshell | “India drops a bombshell on crypto! Only hog-backed currencies supported” – Pushpendra Singh | 508 Likes, 56 Reposts |

| Frustration & Criticism | “RBI’s stance unchanged: Crypto hampers stability. Invite stakeholders for discussion!” — Kashif Raza | 204 Likes, 33 Reposts |

| Adaptation/Pivot | “Web3 builders pivoting to CBDC integrations, sentiment muted due to heavy tax” – Alva App | 0 likes (new post, but in discussion) |

| News Breaking | “India to launch RBI digital currency, no support for unbacked cryptos” – Crypto India | 1,660 Likes, 215 Reposts |

| Policy Shift Call | “Prepare to engage with stables; CBDC not enough for weakening ₹” – Kishore | 8 Likes |

| Exchange Issues | “By bit restricts Indian users due to regulators” – CryptoDaku | 94 Likes |

High engagement in the community (10k+ views on multiple posts) shows that the topic is hot. Retail investors are worried about heavy taxes, while builders are shifting to CBDC integration. Many people are demanding stakeholder meetings to boost innovation. Overall, sentiment is negative but resilient – focus on P2P trading and global exchanges.

User Benefits

Easy withdrawal and instant crypto-to-cash exchanges in India

Despite India’s strict regulations in 2025 (such as FIU registration and 1% TDS), there are many easy ways to convert crypto into cash (INR) instantly. The main focus is on P2P (peer-to-peer) trading, which transfers money to a bank account in seconds via UPI, IMPS, or bank transfer. These methods run on KYC-compliant exchanges, but always choose verified users to avoid scams. Below are the top options and steps.

1. P2P Exchanges: The Quickest and Easiest (Cash in Seconds)

On P2P, you sell crypto (e.g., USDT, BTC) directly to another user, and they pay with UPI/IMPS. As soon as the payment is confirmed, the crypto is released, and the INR arrives in the bank instantaneously. Fees can be low (0-1%), but spreads (market rate differences) can be 0.5-2%.

| Exchange | Instant Speed | Supported Payments | charge | KYC Requirement | Notes |

| Binance P2P | Seconds (UPI/IMPS) | UPI, Paytm, Bank Transfer | 0% Trading Fees | Required (PAN/SUPPORT) | The most popular, 800+ payment methods. Best for INR in 2025. |

| WazirX P2P | 1–5 minutes | UPI, IMPS, NEFT | 0% | imperative | Trusted, easy app for Indian users. |

| Drink | Instant | UPI Crypto Payments | minimum | Basic KYC | Digital wallet style, easy to novice. |

| Bitbns P2P | fast (minutes) | UPI, Bank | 0.25% | imperative | Three-way P2P system, quick withdrawal. |

| CoinDCX P2P | Instant UPI | UPI, IMPS | 0% | FIU Registered | User-friendly, 400+ cryptos. |

Steps of Binance P2P (example):

- Login to the Binance app/website, go to the P2P section.

- Select “Sell”, select USDT/BTC, select INR currency.

- Select UPI/IMPS, enter the amount.

- Match the verified buyer, share the payment details.

- Release crypto when payment is received – INR in instant bank!

2. Direct Exchange Withdrawal: Quick but a little slower than P2P (minutes to hours)

If you don’t want P2P, withdraw INR by selling crypto on the exchange. These are FIU-registered, TDS is auto-deducted.

- Pi42: Instant INR withdrawal (free fee), 5-minute KYC. Best for futures trading, but also spot support. Steps: Sell crypto → Withdraw to bank (UPI/IMPS) – in seconds.

- Coin Switch: Easy INR onboarding/offboarding, FIU registered. Sell → Bank transfer (Minutes).

- Mudrex: Convert BTC to USDT → withdraw (a few hours). The transfer has to be done first.

Tips & Warnings

- Choose UPI for Instant : IMPS/NEFT can be slow.

- Tax: 30% income tax + 1% TDS on every transaction.

- Security: Keep 2FA on, test with a small amount. The RBI’s promotion of CBDC could lead to more restrictions on private crypto.

- If ATMs want: Bitcoin ATMs are limited in India right now, P2P better.

Risks & Scams

Fake Bitcoin ATMs and Scams

Bitcoin ATMs themselves are not fake, but scammers use them for fraud. These scams have grown exponentially in 2025, especially in the US and Canada, where scammers make fake calls (such as the IRS, bank, or tech support) to force people to deposit cash at ATMs. Once the money is put in, the transaction is irreversible, and the scammer disappears. According to the FBI,

the US lost $250 million (about Rs 2,100 crore) in 2024 , double from 2023. The trend continues in 2025, with several cases highlighted in reports from CNN and ABC News.

How does the scam work?

- Fake Calls/Messages: Scammers identify themselves as officers and say that your account has been hacked or is tax due.

- Direct to ATMs: They provide the location of the specific Bitcoin ATM and provide a step-by-step guide (scan the QR code, insert cash).

- Emergency Create: Threats like “do it immediately or jail”.

- Target: Most seniors (elderly) are targeted, but the young are also the victims.

Recent examples (from 2025)

| Event/Location | Details | Damages/Consequences |

| Idaho (October 2025) | Rising scams in Eastern Idaho; Thousands of dollars disappeared from fake investment sites. | $9.9B Global Loss (2024), +40% YoY |

| Cheyenne, Wyoming (September 2025) | Phone scams trying to send money to a Bitcoin ATM; Police Warning. | Multiple cases, false emergency tactics. |

| NC, US (October 2025) | ABC11 Investigate: Millions of dollars lost, gas station worker rescues elderly woman. | $15K-19K saved, 7 scams blocked |

| Global Stats (2025) | Business email scams asked employees to use ATMs. | $250M+ US Loss |

Reactions on X (Twitter): Recent posts have people alerting to scams, such as the “Bitcoin ATM Scam 🕵️” and compliments to heroes (such as gas station clerks). One post said that no real person uses an ATM – mostly for scams.

Tips for prevention

- Never go to the ATM on unknown calls; Verify.

- Check ATM with the Coin ATM Radar app – see the real location and fees.

- Test small amounts, and always use exchanges with KYC.

- Report: FBI to IC3 or local police.

High transaction fees

The biggest problem with Bitcoin ATMs is high fees – they are 10–20 times more expensive than online exchanges (0.1-1%). The average buy fee in 2025 is 10-20%, which comes from selling (markup) and service charges above the market rate. Selling fee 5-7%. These fees target cash users, but there is further damage in scams.

Why are the fees high?

- Operator Profit: Companies like Bitcoin Depot impose a 24% markup (only show a $3 service fee).

- Network + Machine Costs: Maintenance, Location Rent, AML Checks.

- Risk: Unregulated, therefore high charge.

- 2025 Update: FinCEN Issues Notice on High-Fee CVC Kiosks.

Fee range (from 2025 charts)

| Type/Operator | Average Fee (%) | Notes |

| Buying (Buying) | 10-20% | 6.5-20% in the US , Global 5-25% + $1-3 Network Fees |

| Selling | 5-7% | Less, but rarer. |

| Bitcoin Depot | 24% Markup | Hidden, service fee $3 |

| General ATM | 15-30% Total | Transaction + Exchange Rate |

| Online vs. ATM | 0.1-1% vs. 5-15% | ATM 10x more expensive |

Tip: Use Coin ATM Radar to check fees – details of 39k+ ATMs as of 20-Oct 2025. If there are limited ATMs in India, then P2P (like Binance) is better – 0% fees.

Future Outlook

The Future of Bitcoin ATMs in India: Will It Expansion?

Yes, there is a strong possibility of Bitcoin ATMs (or crypto ATMs) expanding in India in the coming time. From 2025 to 2035, the market is projected to have a growth rate (CAGR) of 21.57%, lower than the global average (50%+) but stable and sustainable.

This projection is based on crypto adoption, the growing popularity of digital payments, and government regulatory frameworks. However, uncertainties such as regulations and technical challenges can impact growth. Details below:

Market Projections (2025-2035)

| Year/Parameter | Market Value (in USD Million) | CAGR (%) | keynote |

| 2024 (Base) | 140 | — | Current size, mainly in urban centers. |

| 2025 | ~170 (estimated) | 21.57 | Early growth, with increased adoption. |

| 2035 | 1,200 | 21.57 (total) | 8-9 times increase; Expansion in Tier-2/3 cities. |

These figures are from the Market Research Future report, which suggests that the demand for crypto Bitcoin ATMs will increase with cash-to-crypto transactions.

Drivers of expansion (causes)

- Crypto Adoption: Crypto interest is on the rise among the younger population (18–35 years); India is in the top-3 among global crypto users in 2025. The success of digital payments (like UPI) has led to ATMs being considered as easy entry points.

- Fintech Partnerships: Companies like Unicorn (India’s first Bitcoin ATMs launched in Bangalore in 2018), Zebpay, WazirX, and Cashaa are expanding the network. Example: Zebpay Increased Kiosks in 2023; Cashaa plans more ATMs in 2023.

- Financial Inclusion: The government’s Digital India and Financial Inclusion Policy can lead to expansion in tier-2/3 cities (such as Lucknow, Indore).

- Technology: AI-security, multi-currency support, and a user-friendly interface will increase adoption.

Discussions on X (Twitter) show that the community is looking at Opportunity – like one user who saw an ATM in Istanbul and suggested it for India.

Challenges

- Regulatory Uncertainty: RBI Discourages Private Crypto; CBDT is taking feedback from stakeholders in 2025. No specific ATM regulation, but AML/KYC strict. If the ban or heavy tax increases, then growth may be slow.

- Competition and Technical Issues: P2P exchanges (Binance, WazirX) are cheaper; High fees of ATMs (10-20%) and scam risk.

- Infrastructure: Most Urban Limited right now; Low awareness in rural areas.

Impact of the Regulatory Environment

India’s stance in 2025 is “caucus but open” – the 2018 RBI ban removed, but 30% tax + 1% TDS issued. The government is creating a framework on VDA (Virtual Digital Assets), which will increase legitimacy. The report says: “Easing regulatory climates” will boost growth. If CBDC (Digital Rupee) is integrated, ATMs can shift to hybrid models.

Overall Outlook Bitcoin ATMs

Positive – The market will reach USD 1,200 million by 2035, but dependent on growth regulations. If clear guidelines come in 2025-26, there could be 500-1,000 ATMs (estimated at ~50-100 right now). Community (on X) and investors are optimistic

Conclusion

In summary, Bitcoin ATMs are a powerful tool for democratizing access to crypto, but due to scams, high fees, and regulatory uncertainties, they are like a double-edged sword. The US-centric growth in 2025 (39,000+ global machines) and the popularity of P2P options in India clearly indicate rising adoption, but RBI’s CBDC focus and 30% tax are pushing private crypto into a controlled space.

The crypto community’s mixed reactions—from frustration to adaptation—highlight the demand for innovation. In the future, with a 21.57% CAGR by 2035, 500-1,000 ATMs in India are possible, provided clear regulations emerge. Advice: Always check KYC, start with small amounts, and choose secure options like P2P. The crypto journey is exciting, but awareness is your greatest asset—invest safely and shape the future!