Intro

Solana (SOL), a high-speed blockchain famous for its scalability and low transaction cost, has been a remarkable performer in the altcoin space. On October 1, 2025, its current price is $216 USD and the market cap is $117.6 billion, which keeps it ranked #5 in the crypto market. Its previous all-time high (ATH) ~$294, achieved in 2025, raises the question:

Can SOL reach this peak again and surpass it? This analysis evaluates SOL’s current market status, technical indicators, network strength, institutional adoption, ecosystem growth, regulatory developments, and on-chain activity to assess whether it can hit a new ATH.

Table of Contents

Current Market Status

Based on the data as of October 1, 2025, the current price of SOL (Solana) is $216 USD. Market cap is $117.6B, ranking it #5 in the crypto market. 24-hour trading volume is $7.75B. Compared to BTC/ETH, SOL’s position in the top coins breakdown:

- Bitcoin (BTC) dominance: 58.47% (largest share of the market, strong as store of value).

- Ethereum (ETH) dominance: 12.78% (leader in smart contracts and DeFi, but challenged by SOL’s speed).

- SOL dominance: 2.91% (strong among altcoins, but behind BTC/ETH; growth potential in NFT, DeFi, and high-speed transactions).

SOL is smaller than BTC/ETH, but it is in the top-5 of the altcoin space. The chart shows BTC dominance is high, indicating risk-off sentiment in the market, but SOL’s 2.91% share could increase with ETF approvals (such as SOL ETF rulings).

| Asset | Dominance (%) | Market Cap (approx, chart-based) | Strength |

|---|---|---|---|

| BTC | 58.47 | ~$2.28T+ | High (safe haven) |

| ETH | 12.78 | ~$499B+ | Medium (DeFi leader) |

| SOL | 2.91 | $117.6B | Growing (speed focus) |

Price Trend (Last 7 / 30 Days) – based on TradingView candlestick chart:

- Last 7 days: Price dropped -5.53%. Testing support at ~$185, resistance around ~$294. EMA (20) showing downtrend, high volume but red candles due to selling pressure.

- Last 30 days: Price up +1.56%. July–September 2025 saw a wavering trend, overall neutral-bullish (recovery in August, sideways in September). RSI ~50 (neutral), but volatile due to volume spikes.

Chart Summary: After consolidation from 2025 highs (~$290+), support is holding. Short-term bearish, but ETF news could trigger rebound.

Why Solana Can Reach ATH Again? (Bullish Factors)

Network Strength

- Circulating Supply

- Meaning: How many SOL coins are circulating in the market (available).

- Data: 543.8 million SOL circulating, out of total 610 million SOL.

- 89% circulating: shows network maturity as most supply is already out.

- Active Stake

- Meaning: How much SOL is staked (locked) to secure the network. Stakers earn rewards.

- Data: 407.9 million SOL staked, out of 610 million.

- Delinquent stake: 0% → all active and healthy.

- Live Cluster Stats (core network activity)

- Slot: 370,387,895 – blockchain “tick” number.

- Block Height: 348,557,716 – shows network progress.

- Cluster Time: October 1, 2025, 2:32:16 UTC – current universal time.

- Slot Time Average:

- 1 min average: 394 ms (super fast!).

- 1 hr average: 394 ms – stable speed, no lag.

- Live Transaction Stats

- TPS (transactions per second): 3,253 – very high (Bitcoin ~7 TPS, Ethereum ~15–30 TPS).

- TPS History: fluctuates 0–9,000 (peaks up to 9k).

- Current stable at 3k+, proving high activity without crashes.

source of solana.com

Institutional Adoption

As of September 2025, institutional adoption on Solana has grown:

- Franklin Templeton: Announced money market fund on Solana – first asset manager company to issue securities under SEC registration on Solana.

- Securitize: BlackRock’s BUIDL tokenization partner, announced native support for Solana, enabling tokenized assets and Wormhole cross-chain compliant transfers.

- Societe Generale (SG Forge): Launching MiCA-compliant EUR CoinVertible (EURCV) stablecoin on Solana, plus structured products and bonds.

- Other asset managers: Hamilton Lane, Brevan Howard Digital, and Ondo Finance have expanded offerings on Solana.

Partnerships & Ecosystem Growth

(Documentation till June–October 2025)

- Major institutional partnerships: Franklin Templeton, Securitize, Societe Generale → boost institutional presence.

- Payments expansion: Collaborations with Visa, PayPal, Shopify, Stripe. New products like cross-border apps (Sling Money), Solana-based stablecoins, debit cards.

- Mobile ecosystem: New apps (Jupiter, DRiP, PhotoFinish Live). Solana Mobile’s Seeker and JumboPhone 2.

- DePIN developments: Renewable energy projects, Powerledger migration to Solana.

- Developer growth: Hackathon with 13,600+ participants, $173M private funding in Q3 2024.

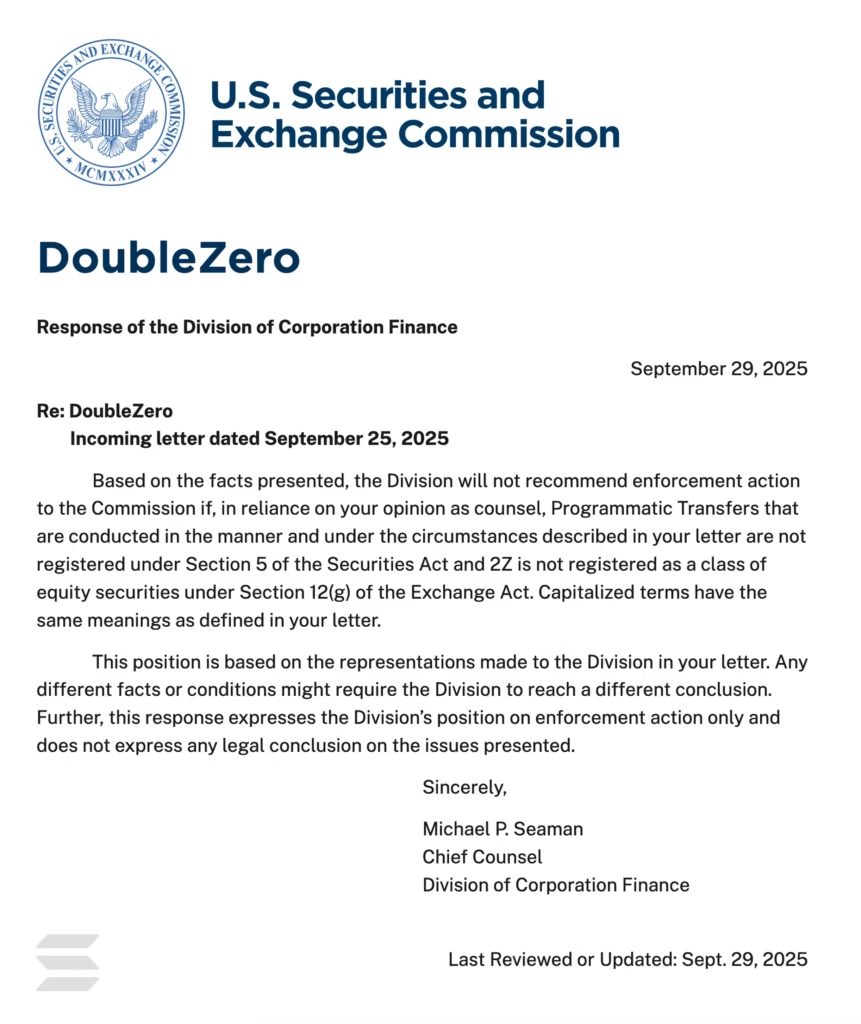

Regulatory News: DoubleZero SEC Milestone

- Overview: DoubleZero, a DePIN project on Solana, connects hardware and real-world infra to blockchain, using 2Z token for programmatic transfers.

- SEC No-Action Letter:

- SEC won’t recommend enforcement if 2Z transfers happen as described.

- No need to register under Securities Act Section 5.

- 2Z not considered equity security under Exchange Act Section 12(g).

- First no-action relief for a crypto token → regulatory clarity.

Impact: Boosts DePIN growth, institutional adoption, and strengthens Solana’s ecosystem.

On-chain Accumulation

(Solana SOL token update, Sept 29, 2025)

- Price jump: +6% in 24h, recovered above $210.

- Cause: ETF speculation (possible October 10 approval).

- SEC role: Deadline for refilings set in July; firms like Fidelity, VanEck added staking features.

- On-chain growth: 2.9B transactions in August, $148M app revenue, 419k SOL added to staking pools in one day.

Technical Analysis

(Based on October 1, 2025 TradingView data)

- Previous ATH: ~$294 (2025 peak).

- Current Price: $208.

- Major Resistance: $240 (breakout → $294 next).

- Major Support: $188 (break → $160 possible).

RSI: ~56 (neutral zone). Dropped from 65 to 56 in past 7 days → balanced, but bullish crossover above 59 could trigger momentum.

EMA 20: Trading above EMA 20 → short-term uptrend.

Volume: 24h volume $6.99B. High, but selling pressure visible.

If SOL breaks $294 resistance, new ATH likely.

Scenarios

- Bullish: Adoption + whale accumulation → SOL can cross $294.

- Neutral: Consolidation between $200–$260.

- Bearish: Global regulation or outages → drop to $160.

Conclusion

Based on the detailed analysis, SOL has a strong chance to break its previous ATH (~$294) and set a new record, provided the right conditions align.

- Bullish case: Institutional adoption (Franklin Templeton, Securitize, Societe Generale), whale accumulation, and ETF approval (possibly by October 10, 2025) could push SOL above $240 resistance toward $294+. Strong metrics—3,253 TPS, 407.9M staked SOL, 394 ms slot time—support this growth, along with SEC clarity for DoubleZero DePIN project. Fear & Greed Index at 42 (neutral) and Altcoin Season Index 56/100 show rising altcoin momentum.

- Neutral case: If sentiment stays balanced and no major catalyst, SOL may range $200–$260. Current RSI 56 and EMA 20 crossover indicate neutral-to-bullish, but high selling volume (6.99B) shows volatility.

- Bearish case: Strict global regulations or network outages could pull SOL below $188 support, down to $160. High BTC dominance (58.47%) also adds risk in risk-off markets.

Final Take: SOL’s path to a new ATH depends on network performance, ETF approval, and institutional inflows. Current technicals show short-term uptrend and strong fundamentals, suggesting a breakout above $240 could point toward $294+, but regulatory uncertainty and market-wide corrections remain risks.